CG Capital is a capital markets development firm focused on enhancing investor awareness for small-to-midcap companies.

We align a company's strategic goals to an institution's investment thesis and fundamentals to create a sound, long-term investment objective.

10%

Market capitalization impacted by GOOD investor awareness

15%

Market capitalization impacted by POOR investor awareness

65%

Management NOT IN SYNC with investors & analysts

Rely on Us

Exclusively experienced Senior Professionals dedicated to attentive, prompt service will manage your business.

Our extensive network within the investment community enables us to target the right institutions that will support your company in the open market and provide research coverage.

Our capital markets experience enables us to combine equity analyst insight with non-traditional investor relations practices to build your company’s presence in the financial markets.

“CG Capital is for companies seeking an experienced and effective communicator in the Investor Relations field. The team is staffed with consummate professionals that are responsive, polished, communicative, and understand large, complex, dynamically-changing global companies and articulate matters with clarity. The company's experience and tact make it a very solid communicator and advocate for client interests.”

Thomas Keresztes,

Senior Vice President

Refco Securities

"CG has a strong understanding of the investment community and has familial relationships throughout the healthcare industry. It quickly helped us take a fresh approach to communicate our story with the right audience. The team has a tremendous, positive attitude and was a pleasure to work with over the past years. I would highly recommend their services to other small-cap healthcare companies."

Steve Armond

Chief Financial Officer

HealthTrackRx

"CG is a very knowledgeable and capable IR firm. They effectively helped us position our story to the marketplace and have been helpful in crafting an IR strategy for our firm."

David Boone

Chief Executive Officer

American CareSource Holdings

"CG is incredibly well connected with an amazing work ethic. The team consistently comes up with effective, creative solutions."

Dan Goldberger

Chief Executive Officer

electroCore, Inc.

What We Do

CG Capital’s extensive network of investor relationships within the institutional and non-institutional investment community is one of the firm’s most powerful assets. Our ability to identify and match the best investors with the right clients is where we add the most value. Focusing on the right investors, we align our clients with investors that are most likely to become shareholders.

We provide value with the following activities:

33% of corporates are developing shareholders internationally...

Executing an international,

targeted buy-side, sell-side and retail awareness campaign that focuses on relevant valuations and liquidity.

Only 26% of corporates use social media actively for investor engagement...

Enhancing investor awareness by developing and distributing equities-focused content to notable investor sites.

10% of corporates leverage the media for investor outreach...

Extending awareness efforts through media placement opportunities on national networks such as; CNBC, FOX Business and Bloomberg TV.

Being descriptive about your company is different from being convincing to investors. Describing your company is easy; convincing investors is difficult. At CG Capital, we build an investment thesis that mitigates the perceived valuation risks, while outlining the potential catalysts of your company’s stock.

We Provide value with the following activities:

Developing an investment thesis and key messages that are consistent with corporate strategy.

Preparing conference call scripts and preparation tools for management complete with anticipated questions and suggested answers.

Drafting and editing of financial releases and other investor-related communications.

When it comes to dealing with pressing corporate or investor relations matters, such as communicating an earnings shortfall, coping with new SEC rules, or anticipating how the investment community will react to a potential M&A transaction, we have the knowledge and expertise necessary to provide insightful counsel. The principals of CG Capital regularly engage with key members of the investment community to gauge changes in investor sentiment and to understand the investment community’s reactions to various company strategic initiatives.

Other consultative benefits include:

Senior-level insight into dealing with corporate investor relations issues.

Feedback from meetings and follow-up interviews to continuously update campaign messaging.

Counsel on regulatory matters (i.e. Reg FD, Sarbanes-Oxley).

The Difference

Your management team has a business to run. Most of our clients do not have the time and resources to be proactive and manage the critical, day-to-day interactions that most investors demand. Our proactive investor relations program serves as a buffer between management and their overly frequent interactions with the financial community.

We provide a timely response to the investment community on behalf of your management team, which goes a long way toward keeping investors satisfied with the attention they rightly deserve. We then follow up with immediate feedback to your management team.

The primary objective of our Capital Markets Development (CMD) initiative is to seed relevant investor interest. To ensure its efficiency and success, we monitor investor activity and money flows within our clients’ respective business sectors to identify new investors that will be the most likely to invest in your company. Our CMD initiatives provide the most effective measure in delivering results. Included in our CMD campaigns are:

Targeting Analytics

Dedicated CMD Associates

Proactive Marketing Materials

The Team

Rich Cockrell

Founder

Rich Cockrell has a combined 20+ years experience in investor relations and as a Wall Street analyst. He has managed Strategic Finance, Financial Planning & Analysis and Investor Relations activities at Fortune 100 and 1000 companies such as Kinetic Concepts (KCI), The Home Depot Inc., El Paso Corp., ING Americas and Motorola. It was early in his career, while an Equity Analyst with UBS, when Rich first discovered his gift for investor relations. His broad experience spans a multitude of key industries and encompasses publicly-traded, pre-IPO, high growth, under-valued and liquidity-challenged companies.

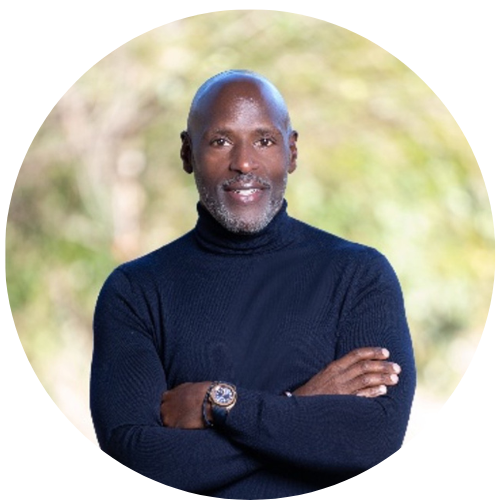

Ralph Dickerson III

Vice President, Capital Markets

Ralph brings over 25 years of experience advising corporate and government clients on a myriad of business, strategic, financial and capital markets initiatives. Throughout his career, Ralph has covered a diverse range of sectors including Consumer, Retail, Industrial/Manufacturing, Healthcare, Media & Entertainment, and Real Estate. He has been directly responsible for and managed completed transactions totaling in excess of $53 billion including principal investing; investment grade, high yield, senior and convertible debt offerings; equity offerings (IPOs and secondaries); as well as buy- and sell-side M&A assignments (domestic and cross-border), leveraged buyouts, and special situations.

Eric Beder

Equity Analyst

Prior to joining CG Capital, Eric M. Beder was a Equity Research Analyst for over twenty years at leading investment banks such as Ladenburg Thalmann, Brean Murray, Wunderlich Securities and B. Riley/FBR, among others, focusing on consumer goods and special situations, including medical, technology and mining. Mr. Beder is a three-time Wall Street Journal Best on the Street winner (in the Apparel and Specialty Retail categories) and two-time Starmine/FT Award winner for stock picking in the Textiles, Apparel & Luxury Goods categories. Prior to transitioning to an equity research analyst role, Mr. Beder worked in the commercial real estate and investment banking field. Mr. Beder received his M.B.A. from The Haas School of Business at the University of California-Berkeley and his B.S., with a major in Accounting/Finance, from The Wharton School of the University of Pennsylvania.

Nicole Jones

Vice President

Nicole brings over 20 years of experience, primarily in the healthcare industry where she has specialized in investor relations program development and strategic communications. She has worked for small-cap biotechnology and biopharmaceutical companies focusing on rare and kidney diseases as well as oncology. Nicole has helped executive management teams with various data and regulatory decisions, commercial launches, numerous capital raises, crisis management, relationships with key stakeholders, and internal communication needs. Additionally, she is a certified executive coach who partners with leaders to help them unlock their true potential to realize their vision and assists with presentation skills, keynotes and TEDx talks.

.png)

Cody Fletcher

Financial Analyst

Cody Fletcher exemplifies leadership and possesses the skills vital for both establishing and upholding effective internal business processes and enhancing the external image and outreach of his clients. With over 12 years in the financial services industry, Cody has collaborated with a diverse clientele, spanning from pre-seed startups to NASDAQ-listed companies. His expertise encompasses Financial Planning & Analysis, Strategic Finance and Accounting, investor outreach, capital raises, website and marketing material design, and comprehensive investor relations support and management.

Engage Us

We’re ready to work on your behalf.

CONTACT

t: 877.889.1972

f: 678.669.1925

VISIT US

Atlanta

CG Capital

309 East Paces Ferry Road NE

Suite 400, Atlanta, GA, 30305